Do I Need to Give Maaser From Stimulus Money?

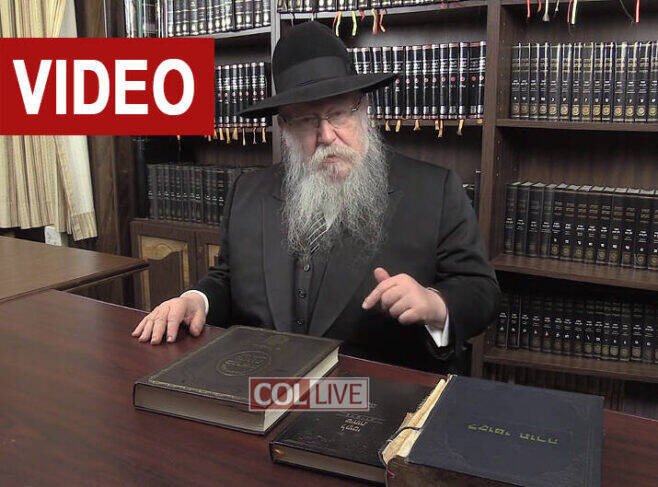

Stump the Rabbi: Do I need to give Maaser from the stimulus and PPP programs? Rabbi Mendel Zirkind answers. Video

Stump the Rabbi: Do I need to give Maaser from the stimulus and PPP programs? Rabbi Mendel Zirkind answers. Video

when u borrow from friend or gmach… are u required to give maaser b4 u pay them back?

No

In the video rabbi zirkind made it clear that you dont take off masser from a loan the same is true of a kmach etc

He said you don’t give Masser on a loan 2:45

Watch the video of RABBI Zirkin discussing the no mask without Eruv. In that video he Paskens about Maaser on found money

One does need to give maaser off of a stimulus check since it a source of income.

As all gifts are chiuv in maaser.

The stimulus is granted even to people who are not by definition poor.

If one truly does not have money they Could possibly be exempt from maaser however there is a הוראה from the Rebbe to keep tract of money owed to maaser.

Dovid Bressman

The shach (based on the Rama) is clear that one does not take off masser from any source of income if that person doesn’t have enough money for their own expenses.

The chiuv only starts on any more money after one covers their expenses

The rebbe shita is that we should always take off masser bhskgofa not mdina

My intent was clear: that as a blanket statement one cannot say that a stimulus is exempt from maaser, this is because it is not absolute that it is only designated for the most basic expenses, For example, if a person has savings or has more than basic needs, the stimulus requires הפרשת מעשר. Plenty of stimulus recipients are not “poor”. Also the purpose of the stimulus is to be in place of lost salary. Obviously if one is completely broke or in debt they are פטור. I mentioned as a side point that the Rebbe wrote to someone who… Read more »

If you watched the video this point was made clear

For those that this money is not needed for basic necessities there is a full chiuv to take masser

It was not so clear.

Bottom line is that stimulus money is like any other salary.

And one who does not have money for the most basic expenses (which is a very broad and not such simple subject which has many opinions in Halacha how exactly this is defined. See for example צדקה ומשפט from Rav Blau which goes in great depth on this topic) accordingly wouldn’t anyways need to give maaser on it.

One can also argue that

No problem we are not necessarily disagreeing.

However it is important to note (and that was my point) that expenses for “basic necessities” is a very broad term.

The Poskim point out that certain “luxuries” that we take for a given should not be misinterpreted as “basic necessities” at the expense of deducting from הפרשת מעשר.

And as I mentioned, the Rebbe did write to people who were unable to give maaser that they should write it down and “pay back” the maaser. I was not addressing if this הוראה is a הוראה לרבים or not, just mentioning it.

See Igros Kodesh 17:262 ; 18:383 ; 27:97 where even one who is unable to currently give maaser because the money will not cover all living expenses, still however some Tzedaka should immediately be given and a calculation of all maaser should be kept so that Im yirtze Hashem when the situation gets better one will be able to pay maaser.

At the end of the video it was point out that the rebbe strongly encouraged us to take off masser and give tzdaka even one who doesn’t have the means. It was also mentioned that there is a criteria for what is considered basic necessities. One point in general about the PPPorgram the main argument is that the money is not being given for individual use or even business use other then what is explicitly stated and therefore the money is not any individual’s money and most only be used for the purposes stated and even if at the end… Read more »

I would like to clarify one point regarding taking Masser from the PPP money. If the owner of the company/business takes a salary from his business then that would considered regular income which would obligate the taking off of Masser. If the owner doesn’t take a salary but rather packets all the profits of the years business. Then there may be a question if that money is considered real profit which would also be obligated in Masser or is “profit” because of the PPP. In other words if the business made no profit of it’s own and only as a… Read more »